Space Business Monthly News

August 31, 2022, Satellite Business Network Co., Ltd.

Editor: Mr. Tsuyoshi Oishi

Publishing manager: Mr. Shigeki Kuzuoka

■ Editorial 01: SmallSat Conference report (KUZUOKA) (see separate report)

■ Editorial 02: Competition in SpaceX frequency spectrum acquisition (OISHI)

■ Editorial 03: Artemis 1 launch postponement (MURAKAMI)

Editorial 01: SmallSat Conference report (KUZUOKA) (see separate report)

Please refer to the separately distributed report on participation.

Editorial 02: Competition in SpaceX frequency spectrum acquisition (OISHI)

When developing a space business using satellites, no matter how great of a business plan you have and how big your wallet is, it all depends on how you can secure and maintain a frequency spectrum. Money hangs below each spectrum like it’s hanging from a tree, and whether a spectrum can be secured or not can be said to be an important factor that determines the launch and continuation of an operator’s business.

Therefore, in the satellite business, fierce competition can occur between satellite operators and terrestrial telecommunications operators toward securing spectrum.

Previously, I had the opportunity to participate in a 10-nation multilateral conference on frequency spectrums. At that time, there was heated exchange, and during the meeting, one person had to chime in to say, “Okay, let’s just stop using nasty words to each other.” Crazy.

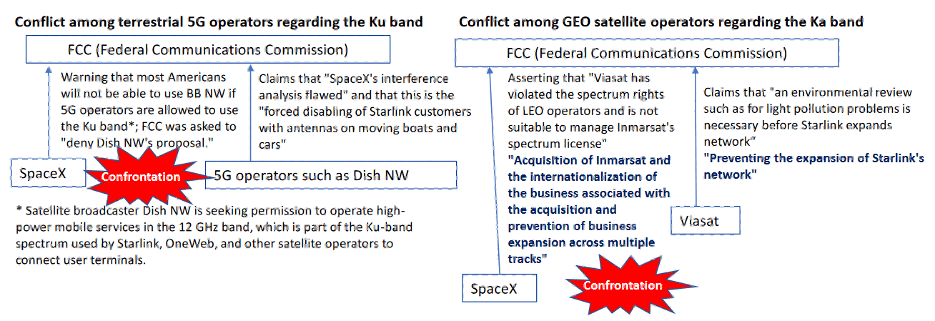

Disputes over frequencies are not limited to specific companies, but currently, anything related to SpaceX, one of the hottest companies in the space industry, gets extra attention. In recent reports, the battlefield can be drawn out such as in the figure at right, toward the acquiring of large spectrums involving SpaceX, such as in conflicts over the Ku band with terrestrial 5G operators and conflicts over the Ka band with GEO satellite operators.

For example, as shown in below, in the dispute with Viasat, SpaceX is trying to prevent or hinder Viasat’s acquisition of Inmarsat and the business expansion accompanying that acquisition. Conversely, Viasat is trying to block the expansion of SpaceX’s Starlink satellite network. In other words, rather than a simple technical debate over spectral interference, this presents a view of a battle for dominance in business.

SpaceX is currently requesting a spectrum in the 2 GHz band for an upgrade to its Starlink broadband service for mobile users. The same frequency band is also used by Dish NW, which is competing for the Ku band, as per the figure above. SpaceX has commented that “Dish has a spectrum license but is not using it effectively”; and this could lead to the expansion of new spectrum acquisition fronts.

At one point, there was a long-standing C-band spectrum issue between GEO satellite operators and terrestrial 5G operators in the U.S. In that same problem, as a result, along with the FCC-led C-band clearance plan, satellite operators received a huge amount of compensation from the FCC in exchange for giving up part of the C-band to 5G operators, leading to special demand for satellites. Conversely, I am paying close attention to how the dispute between LEO satellite operators including SpaceX over the Ku band and terrestrial 5G operators will be resolved.

As noted above, based on frequency planning, it is possible to speculate and grasp the future business plans and directions of each company to some extent. Therefore, including the future trend of SpaceX’s Starlink satellite business, which is attracting attention, we believe that it is extremely important to monitor the movements of each company from a similar perspective.

Editorial 03: Artemis 1 launch postponement (MURAKAMI)

The SLS (Space Launch System), which forms the core of the Artemis project, was scheduled to be launched on the morning of August 28, but the engine pre-cooling line did not function properly, and the launch was postponed. The pre-cooling function itself was performed on the Space Shuttle, and that is not particularly difficult, but during the WET test conducted in July, a leak was found in the hydrogen line, and proper functioning was not confirmed.

There are approx. 100,000 parts that make up a huge system like a large rocket, and I felt that it must be a given that initial failures cannot be completely eliminated. Next launch is set for September 2, and a definite success is hoped for.

Rocket development and operation is difficult. Even SpaceX’s Falcon 9, which has been flying smoothly recently, was unable to complete launch as scheduled when it began launching in 2010, due to technical problems that could not be resolved. At that time, people said: “Who?” “No one needs this company.” “The company won’t last 2–3 years.” Fast forward to now, and SpaceX conducts more than 30 launches a year and has built stable systems.

However, even SpaceX is struggling to develop the Starship. They are aiming for launch within this year, and development is underway. Even with SpaceX, which has gained considerable experience with the Falcon 9, the scale of this craft is unprecedented, and because they are aiming to reuse all stages, everyone can understand how difficult it is. Every time Elon Musk hysterically says that the company will go bankrupt if something can’t be achieved, we all get a sense of how difficult things are.

On the other hand, when the operation of Starship begins and when the target operations are realized, transportation systems will be forever changed. In terms of not only price destruction but also convenience and ability, change is coming. There is the possibility that the time will come when space transportation systems are operated like the aircraft that the Space Shuttle aimed to realize.

This year, many launches are planned for the first launches of next-generation rockets, such as the H3, Ariane 6, and SLS. All of these are expendable rockets, but they form essential systems for launching satellites in each country. I sincerely hope that these debuts will take place early and that operations will be stabilized.

It can be said that it is absolutely necessary for the country to have a system that can be used, when it is still unclear whether the Starship can demonstrate the target performance in the way that the Space Shuttle did.

This is just like Europe used to be. While Europe was unable to achieve the operational performance that the Space Shuttle was aiming for, the Ariane 5 made Europe the no.1 place in the world for market share in terms of launching commercial satellites.

August 2022 Space Business-related Topics by Business Position/Market Field

| OldSpace, etc. | Mixed space, etc. | NewSpace, etc. | |

| Satellites | ■ Beidou-3 positioning system: Providing services to 100s of millions of users ■ SES closes $450 million acquisition of DRS’ satellite communications business ■ Consolidation wave pushes rivals SES and Intelsat into merger talks ■ Insurance claim for failed Measat-3 satellite in dispute ■ Aging Telesat satellite running out of fuel as projected LEO costs soar ■ China launches new satellite toward global quantum communications network ■ Maxar’s satellite business looks to gain foothold in defense market ■ NASA cubesat bumped from rideshare launch because of orbital debris mitigation concerns ■ China successfully launches 16 satellites simultaneously, including remote sensing ■ Increased solar activity creates new challenges for smallsats ■ L3Harris brings Maxar into Tranche 1 Tracking Layer contract with SDA for design + production of 14 spacecraft ■ US Space Force: Taking over all military satellite communications ■ Eutelsat’s software-defined satellite enters commercial service ■ Ball and Seagate test data storage devices for satellites ■ World’s first “remote sensor + health”-dedicated satellite to be launched next year ■ Intelsat working to regain control of Galaxy 15 satellite ■ Report: Industry must face reality that commercial satellites will become targets in war ■ In-flight connectivity market set to double in coming decade (EC Report) | ■ Lockheed invests in Xona’s GPS-alternative constellation ■ SDA to take another stab at space-to-aircraft laser communications ■ FCC considers opening up more Ku-band to non-GEO satellite operators ■ SpaceLink and U.S. Army to study use of relay constellations (Fig.4) ■ Terran Orbital prioritizes work on SDA smallsats ■ Mynaric selected by DARPA to design next-generation optical terminals ■ Intelsat and OneWeb to provide multi-orbit inflight connectivity ■ US Army a key customer of BlackSky’s next-generation imaging satellite ■ SpaceX wins Starlink service contract ($1.9M) in Europe and Africa from US Air Force ■ SpaceLink partners with Parsons for DARPA’s inter-satellite communications project ■ U.S. Army signs agreement to test space data from HawkEye 360 satellites ■ SpaceX and T-Mobile partner for direct-to-cellphone satellite service | ■ Technology to enable AST SpaceMobile’s direct-to-cellphone connectivity from space ■ Spire to host second optical payload for South Korea’s Hancom ■ Sidus Space selects AWS for LizzieSat constellation (Fig.8) ■ SAR imagery from Capella Space added to Orbit Logic’s SpyMeSat app (Fig.9) ■ Descartes Labs acquired by private equity firm Antarctica Capital ■ Blue CT receives largest contract in history for manufacturing smallsats ■ NanoAvionics expands into heavier smallsat market ■ Capella unveils new generation of radar satellites (Fig.10) ■ Orbital Insight and Asterra join forces to monitor infrastructure ■ SpaceX denied nearly $900 million in rural broadband subsidies ■ AccelerComm launches LEOphy layer 1 modem for LEO 5G satellites ■ AST SpaceMobile delays commercial satellite debut by half a year (Fig.11) ■ Ukraine gains enhanced access to Iceye imagery and data ■ Smart and Omnispace team-up to explore possibilities of space-based 5G technologies ■ Megaconstellation startup E-Space expands leadership team ■ Spire and Ursa Space to help detect illicit maritime activity |

| Launches | ■ Rocket core stage launched by China falling into the sea? ■ China launches reusable experimental spacecraft ■ India’s new SSLV rocket fails in first launch (Fig.1) ■ European space development: Expectations for Japan’s H3 rocket in the invasion of Ukraine ■ ESA in talks with SpaceX over launches to replace Soyuz ■ NASA’s first unit of new SLS rocket reaches launch pad ■ As Pentagon shifts to smallsats, issue of ride sharing emerges ■ NASA new “SLS” rocket launch on August 29 canceled | ■ Northrop Grumman and Firefly to partner on upgraded Antares (Fig.5) ■ Small launch vehicle industry growth slows ■ US Space Force certifies Falcon Heavy rocket to reuse boosters, for launching reconnaissance satellites | ■ SpaceX sees continued strong demand for rideshare missions ■ Ceres 1 succeeds 3 times in a row: Chinese private-sector rocket record broken ■ Virgin Orbit reduces launch forecast while increasing per-launch revenue |

| Others | ■ South Korea’s first lunar orbiter on way to the moon ■ Aerospace develops low-cost optical ground network (Fig.2) ■ Telespazio and Inmarsat plan future development of lunar economy ■ FCC considers new rules for emerging space capabilities ■ Canada’s MDA eyes UK expansion ■ US Army looking at new ways to use space tech for unconventional warfare ■ Seeking regulatory mercy: The case for extending the deadline for constellation deployment ■ Intellian signs multi-year partnership agreement with Speedcast to meet accelerated satcom demand ■ NASA unveils candidate landing sites for Artemis astronauts ■ China simulates gravity of Mars: Completion of Asia’s first space field “free fall” steel structure (Fig.3) ■ China succeeds in reuse flight test of suborbital space vehicle | ■ NASA, companies reject concerns over commercial space station development schedules (Fig.6) ■ US Space Force to take on bigger role planning future DoD space investments (Fig.7) | ■ CAPSTONE demonstrates feasibility of low-cost interplanetary smallsats ■ Atlas Space Operations upgrades user interface to ease scheduling ■ D-Orbit cancels SPAC merger plan ■ Turion Space licensed to sell commercial SSA data ■ Orbit Fab announces in-space hydrazine refueling service (Fig.12) |

| Japan | ■ JAXA/satellite EO consortium established for next month ■ JP gov develops key technologies for economic security for 4 fields, such as ocean and space ■ Mitsubishi Heavy Industries unveils H-2A rocket, no.47 ■ Epsilon 6 satellite launch: October 7 ■ Pasco saves labor for forest boundary survey, coordinates via portable equipment ■ Japan’s small probes “Omotenashi” and “Ecculeus” soon to be launched on NASA’s new rocket (Fig.13) | ■ JAXA and Hitachi Zosen succeed in charging/discharging all-solid-state batteries ■ Toward developing insurance for space travel: JAXA and Mitsui Sumitomo Insurance ■ SKY Perfect JSAT selected for SpaceX’s Starship for 2024 satellite launch | ■ Fukushima Prefecture, development of the aerospace industry: Subsidy for French business meetings ■ New rocket launch site builder selected: Nippon Koei, etc. (at Taiki Town) ■ GITAI’s robotic arm completes proof-of-concept demo (TRL 3) (Fig.14) ■ Synspective launches SAR satellite “demonstration commercial aircraft” next month ■ Hokkaido spaceport, construction of rocket launch site LC-1 for small satellites, etc.: Groundbreaking christening and ceremony held on September 7 ■ Synspective develops “slope instability detection feature” for predictive changes + pre-disaster ground deformation with SAR data analysis |